Quantum computing has often been described as a revolutionizing technology with the potential to redefine industries ranging from healthcare to logistics to national security. Yet for all the theoretical breakthroughs and laboratory experiments, skeptics have questioned when—if ever—quantum computing would prove its value in real-world applications. On September 25, 2025, HSBC, in collaboration with IBM, announced what may be the most compelling empirical evidence to date that quantum computing can deliver measurable improvements in finance.

In an industry-first demonstration, HSBC reported up to a 34 percent improvement in predicting trade fill likelihoods in corporate bond algorithmic trading, when using a hybrid quantum–classical approach compared to standard classical techniques. This milestone not only signals progress in financial technology but also strengthens the argument that quantum advantage, while limited and task-specific for now, is edging closer to becoming a commercial reality.

The Challenge of Algorithmic Bond Trading

The corporate bond market is characterized by complexity, fragmentation, and competition. Unlike equities, bonds are often traded over the counter, with less liquidity and transparency. Traders must respond quickly to customer inquiries by quoting competitive prices while managing risk and market volatility.

Algorithmic trading systems assist by rapidly pricing these inquiries. They achieve this by combining real-time market data with risk models to produce automated quotes. To do this effectively, systems must incorporate multiple, complex factors:

- Market conditions (e.g., supply-demand imbalances, volatility spikes)

- Risk factors (e.g., credit spreads, interest rate movements)

- Historical trading patterns

HSBC and IBM’s Hybrid Approach

HSBC’s project with IBM was designed to test whether today’s noisy intermediate-scale quantum (NISQ) machines could contribute to trading models in meaningful ways. Rather than attempting to replace classical algorithms outright, the teams explored how to combine the strengths of both computational paradigms. This pragmatic strategy, centered on hybridization, delivered measurable results.

The approach demonstrated several important outcomes. Each one highlighting how quantum resources can complement existing infrastructures instead of competing with them directly:

- Up to 34% improvement in predicting whether a customer’s trade would be filled at a quoted price.

- Quantum-enhanced models demonstrated greater accuracy under complex conditions than classical models working alone.

- The trial showed quantum resources could complement, rather than replace, existing classical infrastructure.

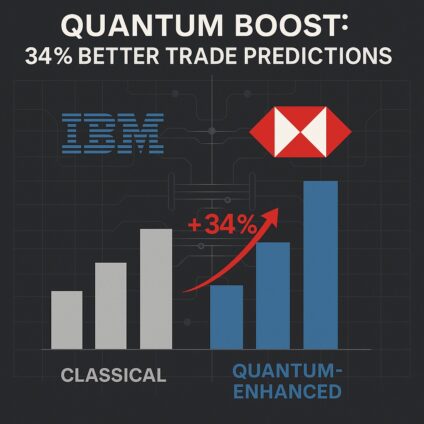

The Visual Story: Quantum Boost in One Image

The accompanying infographic captures the story at a glance. On one side, classical models show modest prediction capabilities. On the other, quantum-enhanced models rise sharply, with the +34% improvement highlighted by a bold arrow.

By pairing HSBC and IBM’s logos with a quantum circuit motif, the image underscores both the collaboration and the scientific foundation of the work. It stands as a reminder that the value of quantum computing can increasingly be seen, not just theorized.

Why This Matters for Finance

Financial markets thrive on information asymmetry and predictive advantage. A fraction of a percentage point in accuracy can mean millions of dollars in trading outcomes. By showcasing quantum’s value in this context, HSBC has made a statement resonating beyond a single trial.

There are several reasons why this advancement is so important to finance, each pointing to both practical and strategic benefits:

- Proof of Value – Tangible evidence that quantum devices can deliver real-world impact today.

- Competitive Edge in Markets – Predictive accuracy in trading is directly linked to profitability.

- Operational Efficiency – Offloading certain tasks to quantum resources allows traders to focus on complex deals.

- Strategic Signaling – HSBC’s announcement may spur industry-wide adoption.

The Broader Context: Quantum in Finance

While HSBC’s announcement is noteworthy, it is part of a larger wave of financial experimentation with quantum computing. Over the last decade, banks and asset managers have quietly been funding pilot projects and partnerships to test feasibility. The HSBC–IBM milestone provides a concrete benchmark against which these other projects will now be measured.

Several financial institutions have already entered into the quantum space, though few have yet shown empirical improvements. Notable examples include:

- JP Morgan Chase has experimented with quantum algorithms for portfolio optimization and option pricing.

- Goldman Sachs has invested in quantum startups and explored error-mitigation techniques.

- BBVA has partnered with academic institutions to assess quantum use cases in risk modeling.

Understanding the 34% Improvement

Numbers in finance often invite skepticism, so it is important to clarify what HSBC means by a “34% improvement.” The figure does not represent returns, profits, or absolute margins. Instead, it refers to predictive accuracy in modeling whether trades would be accepted at quoted prices.

This distinction matters because prediction quality is the lifeblood of algorithmic strategies. By reducing uncertainty and error, the models helped avoid costly missteps such as:

- Overpricing: Losing the trade entirely.

- Underpricing: Winning the trade but sacrificing margin.

Quantum and Classical: A Complementary Future

Rather than envisioning a quantum takeover, the more realistic view is one of coexistence with classical (current-day) computing systems. Hybrid systems leverage the stability and scalability of classical infrastructure while tapping into the specialized strengths of quantum processors. The approach mirrors previous shifts in computing, such as the rise of Graphics Processing Units (GPU) alongside Central Processing Units (CPU).

The HSBC trial reinforces this complementary model. Specifically, it showed that quantum processors excel at challenges where classical systems struggle, including:

- Combinatorial optimization problems

- High-dimensional probability modeling

- Detection of nonlinear correlations in market data

Potential Challenges Ahead

Despite its promise, quantum adoption in finance will not be without obstacles. Current hardware is still limited in scale, and error rates remain a pressing challenge. Moreover, integrating these systems into live trading environments requires careful calibration and significant resources.

Several hurdles stand out as the most pressing concerns for industry adoption going forward:

- Hardware Limitations: Current devices are noisy (error-prone) and limited in scale.

- Integration Costs: Embedding quantum resources requires infrastructure and talent investment.

- Scalability: Scaling trial improvements to production workloads is a challenge.

- Regulatory Oversight: Regulators must ensure fairness and transparency in quantum-assisted trading.

Strategic Implications for the Industry

Beyond technology, the strategic dimensions of HSBC’s trial may shape the future trajectory of quantum adoption in finance. Banks, regulators, and technology providers will interpret these results as signals of what is possible and what investments may be justified.

The implications are wide-ranging and touch on multiple aspects of the ecosystem:

- Acceleration of Investment – HSBC’s results may de-risk quantum adoption for others.

- Technology Partnerships – Banks will deepen ties with quantum leaders, for example, IBM and Google.

- Talent Race – Demand will continue to grow for professionals with both finance and quantum expertise.

- Global Competition – Financial markets may become proving grounds for national quantum strategies.

Watershed Moment

HSBC’s collaboration with IBM represents a watershed moment in the journey of quantum computing from theoretical promise to commercial reality. By demonstrating a 34% improvement in a live, industry-relevant use case — algorithmic bond trading — this trial provides empirical evidence that quantum computing can enhance real-world decision-making today.

While challenges remain in scaling, integration, and regulation, the broader implications are profound. Quantum is no longer five years away. For finance, at least, it appears to be here — and delivering results.